Which of the Following Is a Limitation of Activity-based Costing

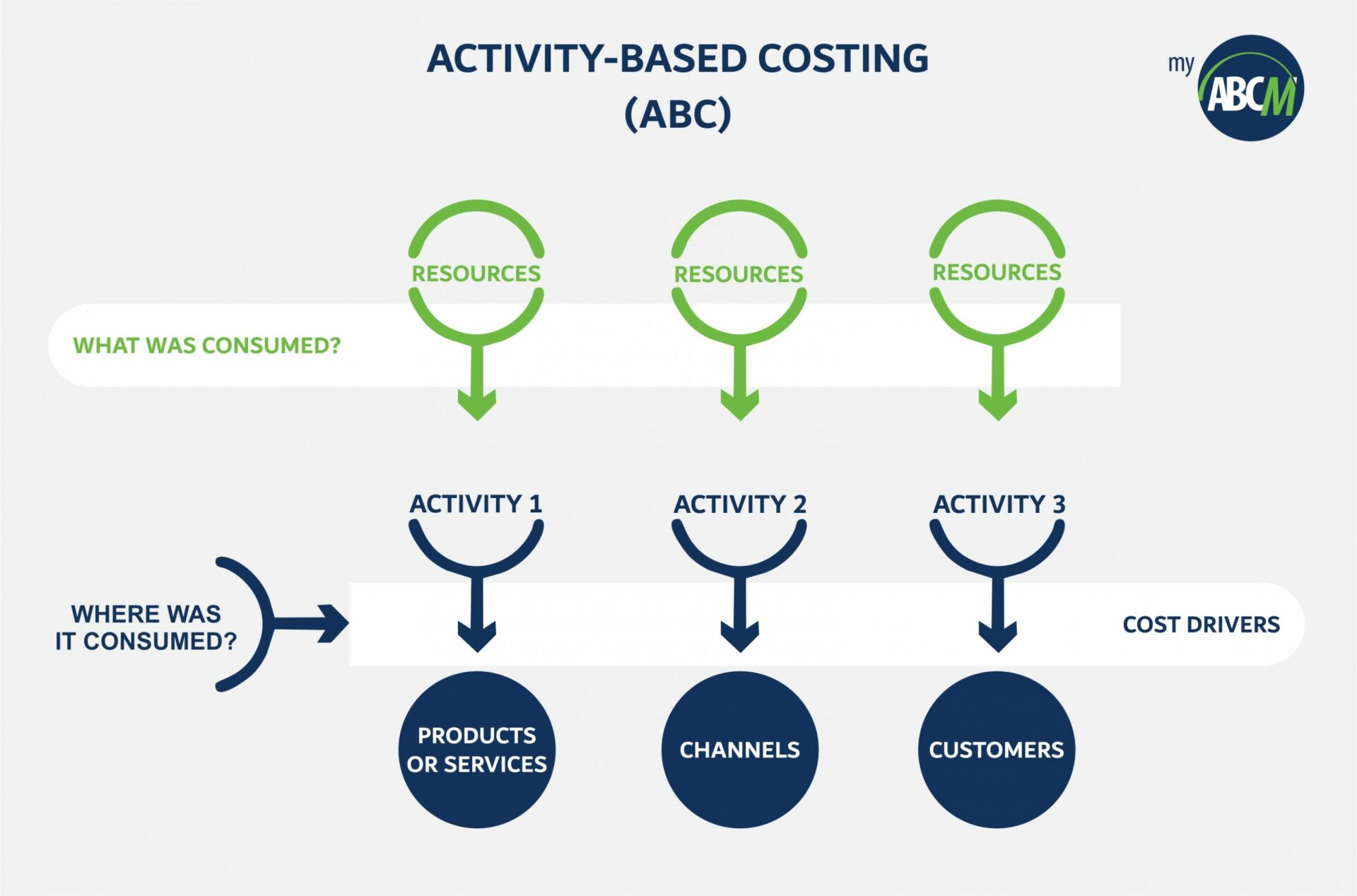

48370 machine hours 38 1838060 overhead applied. In ABC the assumption is that activities use resources or cause costs.

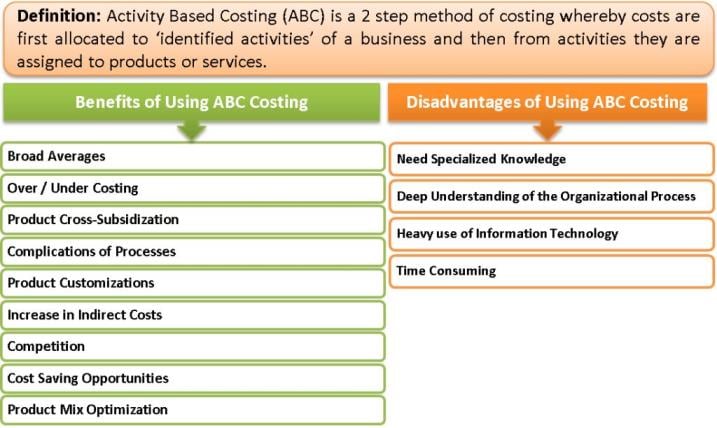

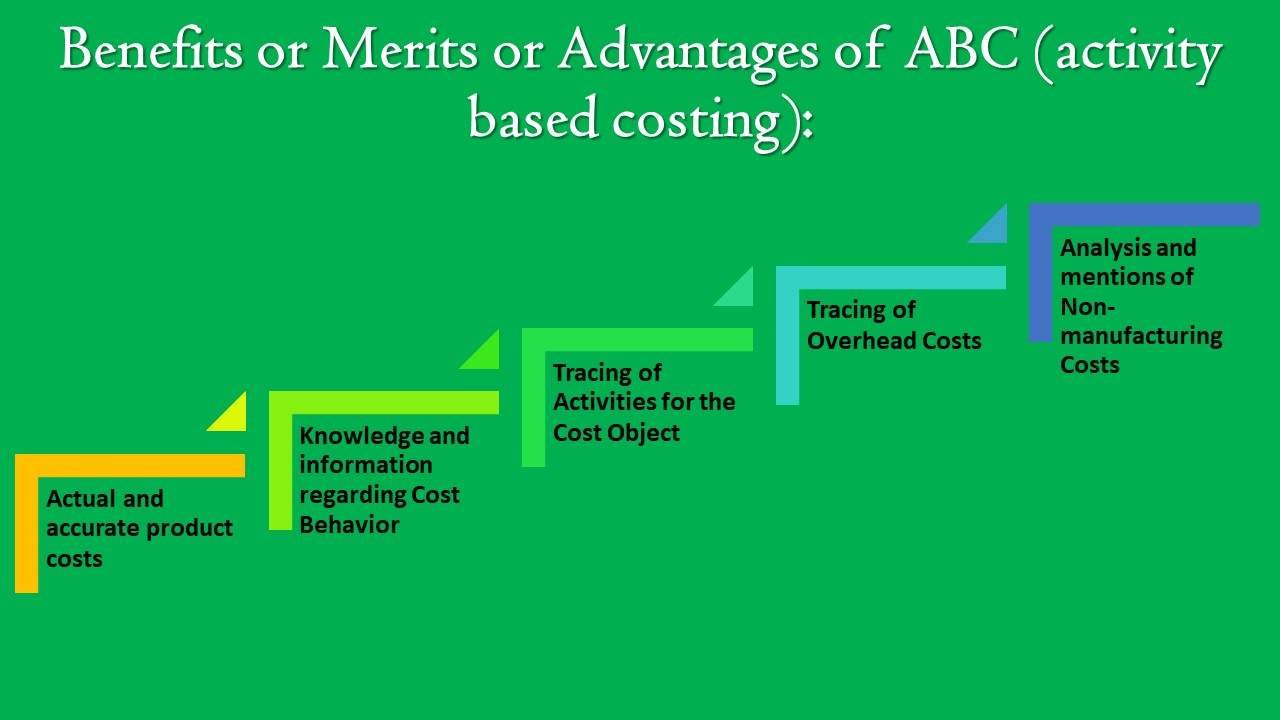

Activity Based Costing Benefits Disadvantages Of Using Abc Costing

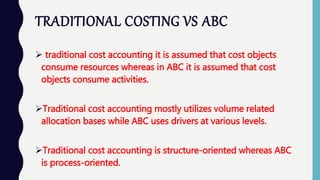

A Maintaining an activity-based costing system is more costly than maintaining a traditional direct labor-based costing system.

. More cost pools are used. It decreases control over overhead costs c. ABC leads to poorer management decisions.

Because the costing takes more information into account the data that is brought forward can make it seem like activity based costing is taking away profits instead of saving them. Each of the following is a limitation of activity-based costing except that a. A frequently cited limitation of activity-based costing is.

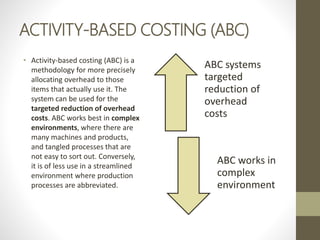

A Cost and Benefit. Since there are a lot of steps and groundwork required to come out with a costing based on this system it is quite a time to consume. 2 despite an ABC system helping decision-makers to manage overhead costs and understand profitability of products and customers ABC has many limitations or disadvantages.

B Changing from a traditional direct labor-based costing system to an activity-based costing system changes product margins and other key performance indicators used by managers. Some arbitrary allocations continue. It is more complex than traditional costing.

Changing from a traditional direct labor-based costing system to an activity-based costing system changes product margins and other key performance indicators used by. Each of the following is a limitation of activity-based costing except that a. Each of the following is a limitation of activity based costing except that.

B If management is not thinking to use ABC information an absorption costing system may be simpler to handle. Estimated annual overhead costs Predetermined overhead rate Expected annual operating activity 1972960 38 per machine hour Determine the amount of overhead applied for the year. It is more complex than traditional costing.

Calculate the predetermined overhead rate. ACTIVITY-BASED COSTING ABC 27. Which of the following is NOT a limitation of activity-based costing.

Which of the following is a limitation of activity-based costing. Activity-based costing can be expensive to use. The time and cost of producing the information Cost pools tend to be more homogeneous than using one-plant-wide rate Benchmarking Sunk Costing O Variable costs are higher when using ABC.

Limitations of Activity-Based Costing ABC 1 ABC will be of limited benefit if the overhead costs are primarily volume related or if the overhead is a small proportion of the overall cost. Each of the following is a limitation of activity-based costing except that it can be expensive to use. Activity-based costing can be used only if approved by the Institute of Management Accountants.

48370 machine hours 38 1838060 overhead applied. Which of the following is false about activity-based costing. Some arbitrary allocations continue.

It is complex and can be difficult to understand d. It may have limited value for some organizations. It can be expensive to use.

Which of the following is a limitation of activity-based costing. 15 Which of the following is a limitation to Activity-Based Costing ABC. A Costs are accumulated by each major activity b A variety of activity measures are used c All costs in an activity cost pool pertain to a single activity d Activity-based costing relies on the assumption that the cost in each cost pool is strictly proportional to its cost measure.

Which of the following is a limitation of activity -based costing. Bcertain overhead costs remain to be allocated by means of some arbitrary volume-based cost driver such as labor or machine hours. ABC results in more cost pools being used to assign overhead costs to products.

It can be expensive to use b. Maintaining an activity-based costing system is more costly than maintaining a traditional direct labor-based costing system. More cost pools are used.

More cost pools are used. According to Accounting for Management 2012. AABC results in more cost pools being used to assign overhead costs to products.

A frequently cited limitation of activity-based costing is. Activity-based costing systems can only be used by firms with a state-of-the-art technology. Some arbitrary allocations continue.

Maintaining an activity-based costing system is more costly than maintaining a traditional direct labour-based costing system. A Costs are accumulated by each major activity b A variety of activity measures are used c All costs in an activity cost pool pertain to a single activity d Activity-based costing relies on. Implementing an ABC system is a major project that requires substantial.

It is more complex than traditional costing. It can be expensive to use. Changing from a traditional direct labour-based costing system to an activity-based costing system changes product margins and other.

CABC leads to poorer management decisions. Certain overhead costs remain to be allocated by means of some arbitrary volume-based cost driver such as labor or machine hours. Limitations of activity based costing are.

Activity-based costing can only be used by firms involved in. Which of the following is not a limitation of activity-based costing. Accounting questions and answers.

Some arbitrary allocations continue. Some argues that the cost of implementing and maintaining an Activity Based Costing system can exceed the benefits of improved accuracy. Implementing an activity-based costing system is more costly than implementing a traditional cost allocation system.

Which of the following is not a limitation of activity based costing a Maintaining an activity based costing system is more costly than maintaining a traditional direct labor based costing system bchanging from a traditional direct labor based costing system to an activity based costing system changes product margins and other key performance indicators used by.

Activity Based Costing Everything You Need To Know About The Abc Methodology Myabcm

Limitations Of Activity Based Costing Abc Assignment Point

Difference Between Traditional Costing And Activity Based Costing Which Is Better Finlawportal

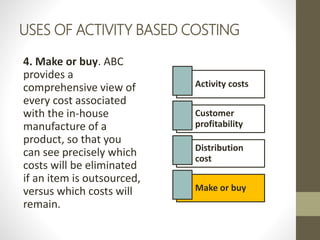

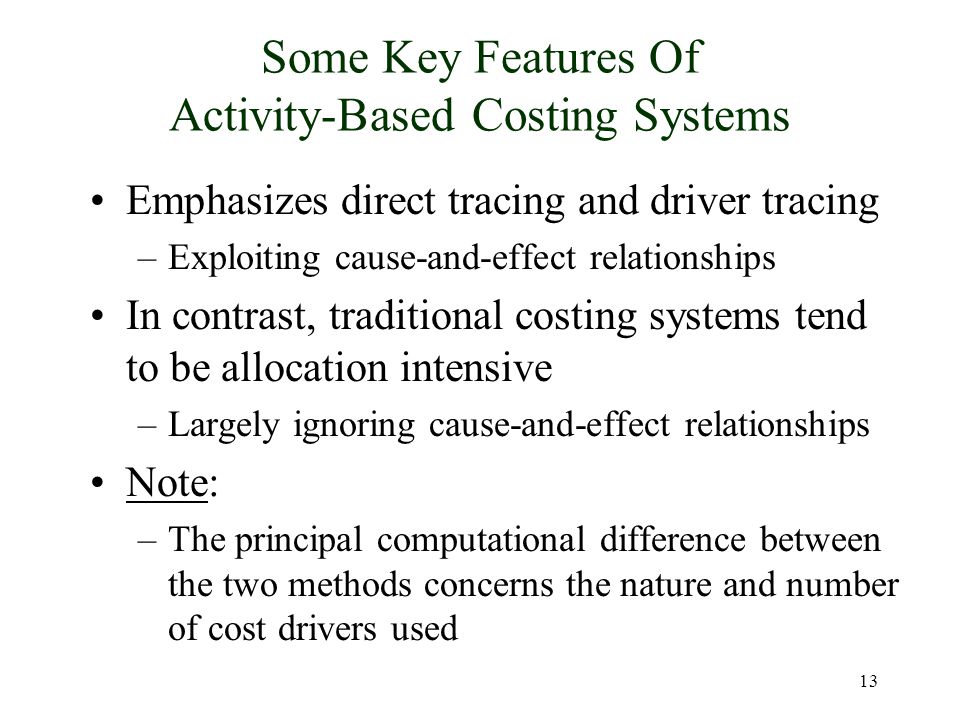

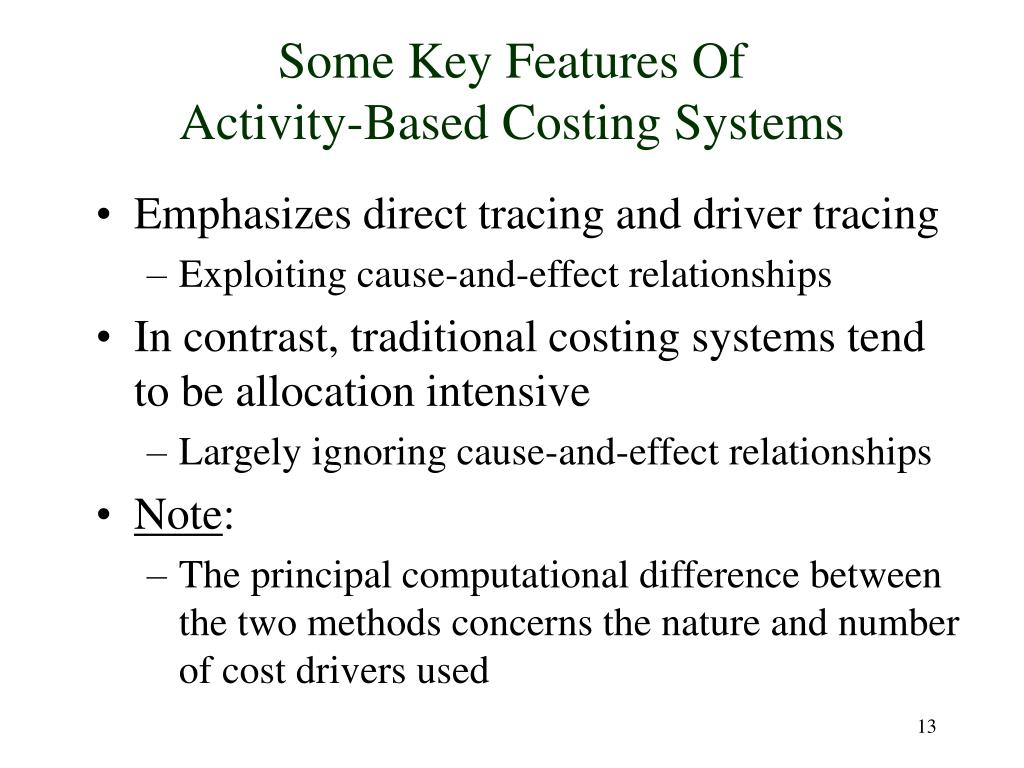

Activity Based Costing A Tool To Aid Decision Making Ppt Download

Activity Based Costing A Tool To Aid Decision Making Ppt Download

Activity Based Costing A Tool To Aid Decision Making Ppt Download

Chapter 11 Activity Based Costing And Accounting Information

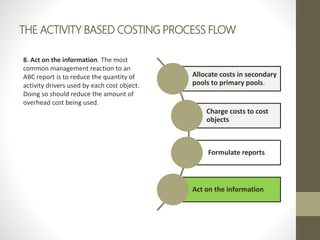

Activity Based Costing Management Abc Abm System

Chapter 11 Activity Based Costing And Accounting Information

Activity Based Costing Meaning Features And Advantages Ilearnlot

Activity Based Costing Abc An Effective Tool For Better Management Semantic Scholar

1 Activity Based Costing Chapter 7 Accounting Principles Ii Ac Fall Semester Ppt Download

Ppt Activity Based Costing Chapter 7 Powerpoint Presentation Free Download Id 1185989

Generic Steps For Time Driven Activity Based Costing Implementation Download Scientific Diagram

Chapter 11 Activity Based Costing And Accounting Information

Proposed Modified Framework For Time Driven Activity Based Costing Download Scientific Diagram

Ppt Activity Based Costing Chapter 7 Powerpoint Presentation Free Download Id 1185989

1 Activity Based Costing 2 Introduction In The Past Overhead Costs Were Relatively Small And The Problems Arising From Inappropriate Overhead Allocations Ppt Download

Comments

Post a Comment